- Emerging Markets GDP growth is set to outpace developed counterparts

- Valuations are attractive

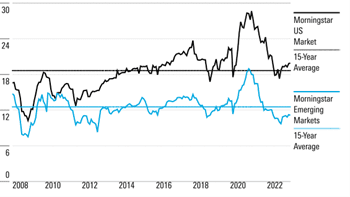

Equities – P/E is well below its 15-year average

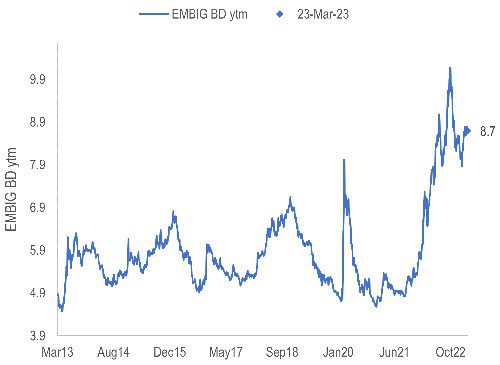

Bonds – JPMorgan Emerging Market Bond Index Global Broad Diversified is yielding 8%, close to all-time highs - Inflation is trending downwards faster in EMs

and this is accompanied by the first signs of interest rate reductions. - Fiscal position of EMs is far better than major developed countries

GDP growth in EMs is projected to be 3.9% in 2023, set to considerably outperform developed markets at 1.3%, and the world average at 2.8%. Historically, the performance of EM indices has been linked heavily to China. However, China’s economic recovery has been underwhelming, primarily due to a slow recovery in its real estate sector, coupled with weak export demand. Despite this, China is on track for GDP growth of ~5% – far ahead of its developed peers. GDP growth in the UK and US has been projected at -0.3% and 1.6% respectively.

However, markets do not appear to have factored this in. Currently, emerging markets are trading at a P/E of 11.5x, which is below their 15-year average of 12.5x. EM equities have been trading at significant discounts to major markets such as the US.

Moreover, the inflation and interest rate picture looks promising. CPI rates in EM have trended down over the course of 2023, driven primarily by easing energy and food price pressures, whilst core inflation has also begun to fade. In April, headline CPI rates in EM nations, as measured by an equal-weighted average of headline inflation in 17 major EMs, fell below 9%, from 10% in January, and has since continued on a downward trajectory.

Emerging Markets reacted rapidly to global inflationary pressures in 2021, engaging a series of rate hikes. This has continued into 2023. Consequently, the majority of EM central banks have now completed their rate hike cycles, and will now look to cut rates before the developed world – a trend which is already taking shape. Markets may not have priced this in, as yields are nearing 10-year highs (excluding the geopolitical spike):

Emerging markets also appear to maintain better fiscal health than developed nations, thus furthering the case for EM credit. The average debt-to-GDP ratio in developed markets stood at 112.42%, ~1.6x that of EM, at 68.84%. Typically, this stark contrast also tends to be structural, primarily due to a less-pronounced welfare system in EM and lower creditworthiness, which causes a lesser ability to borrow. Despite fears that China’s macro leverage has been growing, it still maintained a debt-to-GDP ratio of 82.43% in 2023. By contrast, figures for the US and UK sit at 122.23% and 106.25% respectively.

Overall, an expected calmer macroeconomic outlook in Emerging Markets gives rise to prospects of strong returns for investors, which markets do not appear to have fully recognised.

Disclaimer: ‘Where the business has expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice. The information contained within this communication is believed to be reliable but Realm Investment Management Limited does not warrant its completeness or accuracy.

This communication is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell investments.’