An update on the oil sell-off and current smart-money positioning.

We published a post on 20th October Oil rally may stall – what does the smart money think?

In the post we suggested that “a setback is due, noting the overbought condition”.

Since that date we have seen a sharp decline in price with oil falling more than 25% from its recent high. Over the last few days price has recovered a little but it remains to be seen if this month’s low will be broken or if oil will continue to trade higher from here.

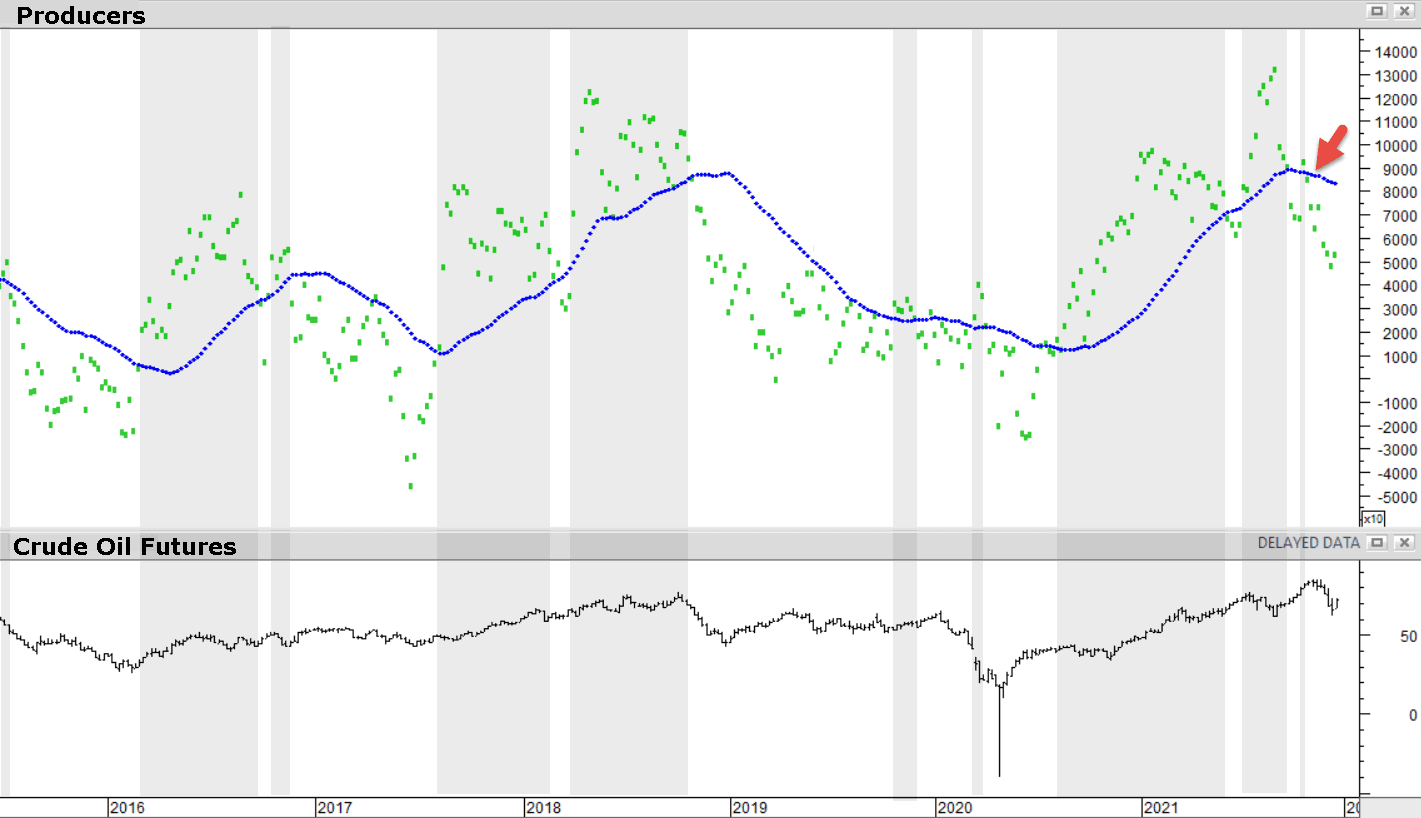

As explained in the earlier post, our Smart Money Indicator for oil is the net positioning (longs minus shorts) of the Producers category of Crude Oil futures traders, as recorded each week in the Commitments of Traders Report (source Commodity Futures Trading Commission). This is shown in green on the chart. We watch their net position relative to an average line, shown in blue.

In the previous post we also wrote that we “would expect any weakness to be bought as long as our Smart Money indicator keeps trending higher”.

As you can see from the chart below, just before the sell-off began the green line dipped back below the blue average line (see arrow) which meant our Smart Money indicator was (and is) no longer trending higher.

We have found from studying historical data that long positions in oil are more likely to be profitable if the Smart Money indicator is above its average – see shaded areas on chart. Currently it is not. We need more evidence before we turn bullish again on oil.

Disclaimer: ‘Where the business has expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice. The information contained within this communication is believed to be reliable but Realm Investment Management Limited does not warrant its completeness or accuracy.

This communication is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell investments.’