Global pharma stocks have posted strong returns over the past two months and have outperformed broader markets aided by healthy 3Q2021 earnings season, please refer our previous update Global Pharma – the other growth story. Emergence of omicron variant too has brought pharma stocks into focus due to the larger than estimated demand for booster doses and need for development of improvised vaccines specifically targeting the new variant. However, broader markets have been weighed by fears of stagflation due to escalating inflation coupled with prospects of slowdown in economic activity caused by omicron. Central Banks now seem more concerned that the high inflation is not transitory. US Fed has indicated the possibility up-to three rate hikes in 2022 and has also accelerated the tapering of its Bond Purchase program, which is now expected to end in March 2022 (vs. earlier planned mid-2022). Bank of England too recently raised interest rates by 15bp to 0.25%.

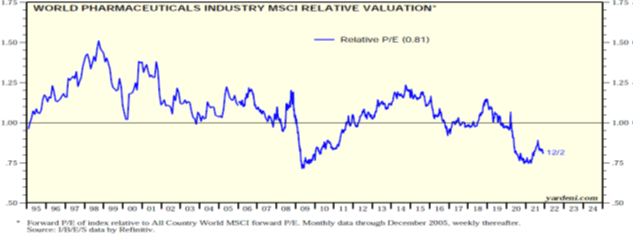

Global Pharma/Health sector offers a strong investment case in the current scenario. Companies in the sector offer impressive earnings yield along with healthy balance sheet and are available at moderate valuations. Current Relative P/E for the sector at 0.81 is well below its long term average. (Refer Exhibit 2 below)

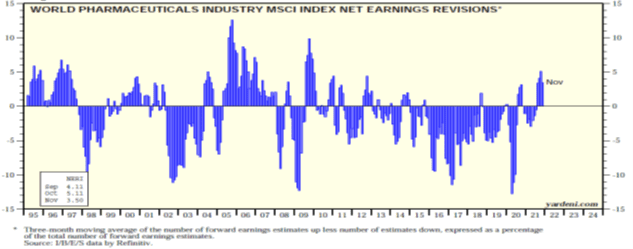

Exhibit 1: World Pharmaceuticals Industry MSCI Index Net Earnings Revisions

Exhibit 2: World Pharma Valuation

This communication is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell investments.