Global equity markets were mixed in 2021 as strong performance of developed markets aided by favourable fiscal and monetary policies contrasted the largely modest performance in other regions. However, with global inflation continuing to remain at elevated levels, central Banks are soon expected to start hiking rates. With current real rates in US at never-seen levels of -7%, the US Fed is expected to announce three, or perhaps four rate hikes in 2022, potentially starting in March.

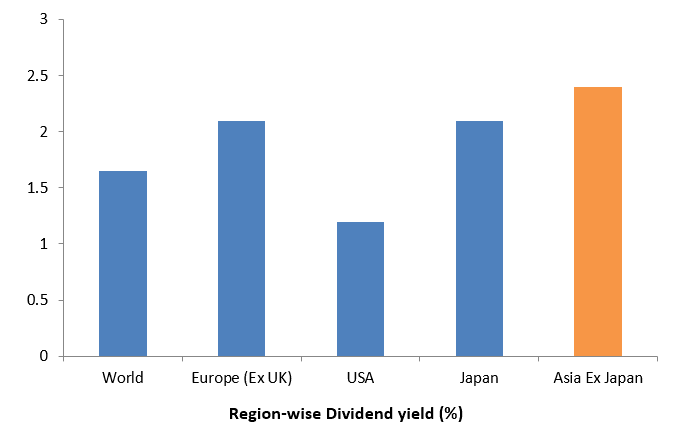

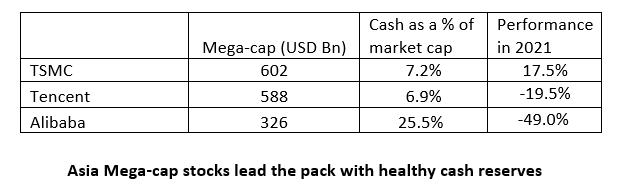

Asian markets which were weak in 2021 (MSCI Asia ex-Japan down 6.3%) could act as a hedge in a rate hike cycle due to the presence of a large number of companies with net cash positions and strong balance sheets. Low valuations and high dividend cover further boost the investment case for Asian equities. Asia Pacific companies are estimated to pay US$360bn as dividends in 2022 offering a dividend yield of ~2.5%. Furthermore, robust pick-up in vaccination rates is expected to help economic recovery in the region. Meanwhile, policy headwinds in China too are expected to subside going ahead acting as a major positive for Asian stocks.

Disclaimer: ‘Where the business has expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice. The information contained within this communication is believed to be reliable but Realm Investment Management Limited does not warrant its completeness or accuracy.

This communication is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell investments.’